Sintex Plastics Technology (SPTL, market cap: Rs 5114 cr), a plastic processing major better known for its water storage products caters to varied end markets – automotive, electricals, housing. Demerged out of Sintex Industries last year the company is witnessing a major business transition as government orders have slowed down for its prefab business.

While company’s strategic move to focus on balance sheet repair is a key positive, near term earnings visibility is moderate.

Demerged business: Sintex Plastics Technology.

Sintex Industries demerged (effective 12th May 2017 ) its custom moulding and prefab businesses into a wholly-owned business - Sintex Plastics Technology and listed it on stock exchange on August 8, 2017.

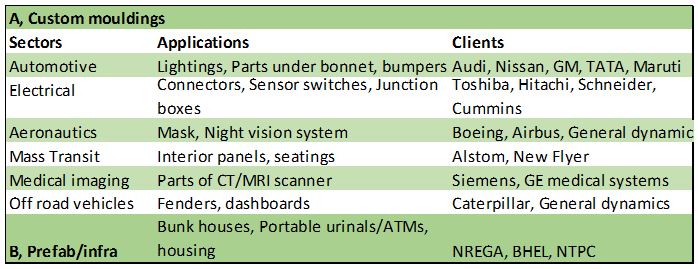

SPTL has broadly two business divisions. Custom molding (65 percent of 2017 sales) division that manufactures a large range of custom moulding products for the automotive, defence, aerospace, electrical sectors. Whereas Prefab/Infra division (35 percent of sales) makes prefabricated and monolithic structures for rural and urban social infrastructure. Headquartered in Kalol (Gujarat), company has 36 manufacturing units spread across India, Europe, the USA and North Africa, where 34 percent of the business is from overseas.

Custom moulding market prospects are positive

As per estimates from the company, Indian market for custom moulding is expected to reach Rs 16,16,000 crore by 2026 (CAGR of 12 percent) driven by demand in electrical, electronics, automotive sectors. Along with that, government’s thrust on infrastructure and defence indigenisation adds to the demand for composites.

Government’s social sector programs aids long term growth

Strong long term growth levers exist for prefabrication business as the government’s spending in social sectors - healthcare, sanitation, education continue to remain prominent. Company’s offering in this segment addresses needs for defence shelters, structures for sanitation, Anganwadis, healthcare infrastructure, warehousing/cold chain and affordable housing. Thus, SPTL’s business solutions meet the huge requirements of GoI’s priority programs like Swachh Bharat Mission and Housing for all.

Business risk

Cost of raw materials, particularly those derived from Oil like HDPE/LLDPE (High Density poly ethylene/linear low density poly ethylene), PVC are the key risk given the recent surge in petrochemical prices. Further, hardening of interest rate impacts debt servicing cost (D/E: 1.18).

Having said that, SPTL is utilizing its cash flows to trim debt (reduced by Rs 286 crore in 9M 2018). In light of this and also due to high working capital requirement, company has steadily reduced its exposure to monolithic and infra business which depends a lot on state government investment, approvals and policies.

Sintex Plastics – weak numbers in Prefab/infra division

Sintex Plastic’s (SPTL’s) Q3 2018 result was weaker than expected. Company continues to face transition challenges for the demerged entity along with the strategic shift which is more focused on custom moulding. Sequentially, sales were down 7 percent, weighed by weak numbers in prefab/infra division.

Prefab/infra division is impacted by reduced orders from Government as the new entity needs to undergo an approval cycle which would take time. At the same time, company has also strategically shifted its focus to custom moulding division, particularly retail where working capital requirement are low.

Custom moulding division has been aided by European operations and retail, automotive and electrical end markets in domestic business.

Business outlook

As the company faces transition headwinds, FY 2018 sales is expected to be a tad weaker than FY17. FY19 and onwards, the company would be focused on traction in custom moulding division. In FY 2019, the company expects 60 percent revenue in Custom moulding division to come from domestic market mainly in the automotive, electrical and retail segments where in growth could be in the range of 20 percent. Company’s international business in the Custom moulding division is expected to clock sales growth in the vicinity of 10 percent aided by aerospace, defence market performance mainly in Europe.

Prefab/infra business is expected to pick up with government orders towards the last quarter of FY 2019.

Balance sheet repair is the key focus

Company’s key focus is on repairing the balance sheet wherein the company is consciously not taking any major capex till they reduce the Debt/EBITDA to lower than 2 (3.8 in FY 2017). Company expects to achieve this by focusing on business with low working capital requirement like retail (Rs 600 crore: ~10 percent of sales) and restructure the debt (increase tenure, reduce interest cost).

Overall, though company benefits from the improving end markets, particularly in custom moulding division, transition in prefab/infra market would take time. Due to this reason, near term earnings visibility is moderate. Although, the trailing multiples look attractive, in our view, stock is currently trading at 24x 2018E earnings which is expensive. Key monitorable is the progress in debt reduction and how far traction in Custom moulding division can offset the Prefab/infra division slowdown. Though we like the end market trends, we would wait for better earnings growth traction to get constructive.